This Valentine’s Day, take a moment to reflect on your relationship with money. You might be surprised at how you can improve it.

Every Valentine’s Day, many of us are scrambling for original ways to show our loved ones we cherish our relationship. However, one of the relationships we often overlook is the one we have with money.

Some people might think they have a healthy relationship with money based on their wealth or status, but the number in your bank account doesn’t necessarily define how healthy that relationship is. This Valentine’s Day, take the time to reflect on your own relationship with money and consider if there are ways you can improve it.

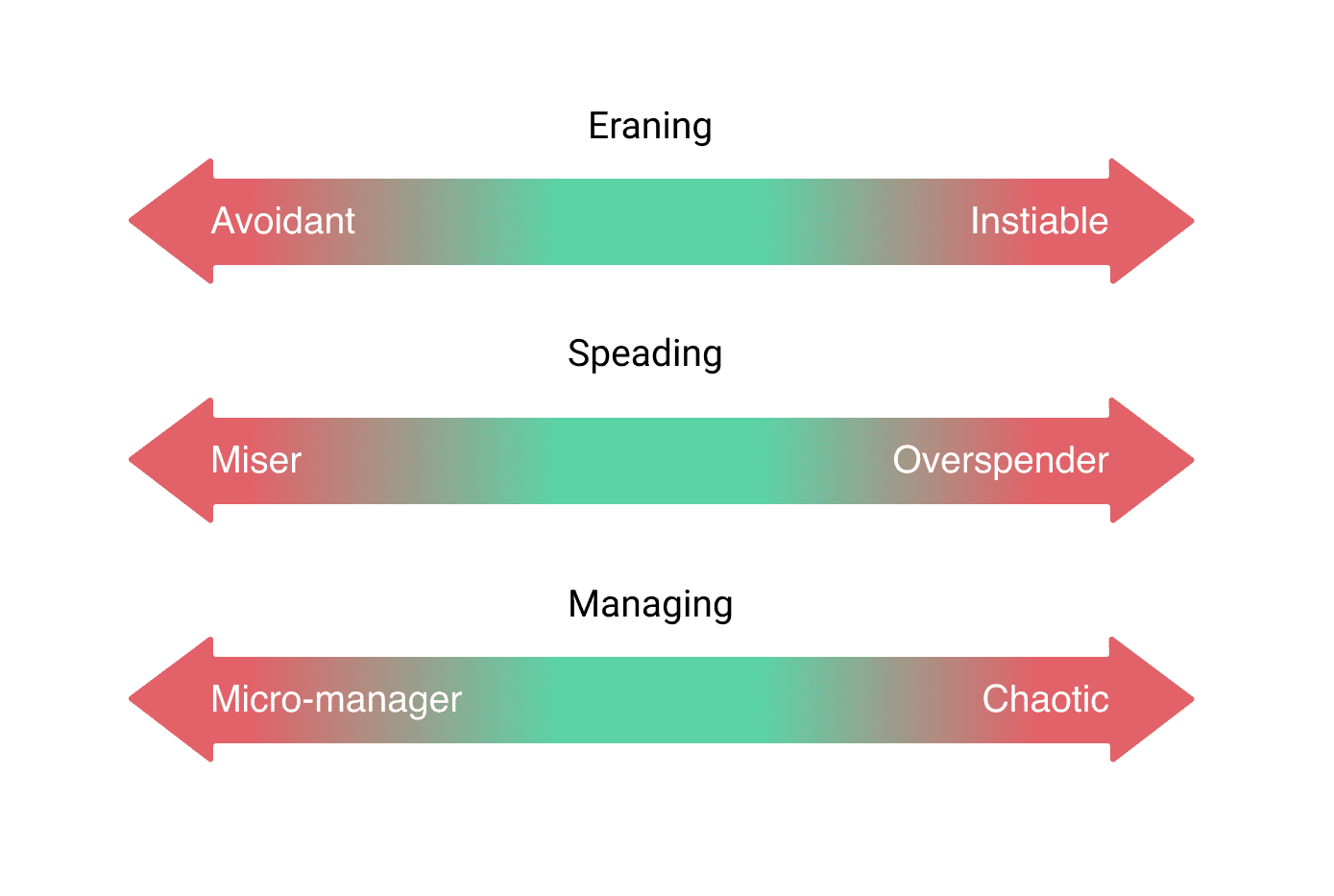

In her article “Understanding Our Relationship With Money,” Eileen Gallo, a psychologist focusing on the psychological and emotional aspect of wealth, points out three dimensions of how we qualify our relationship to money: acquisition, use, and management. Understanding how we individually navigate each of these dimensions can help us gain more insight into our own habits and emotions tied to money.

The Three Dimensions of Money

In the dimension of acquisition (earning), we look at how much money a person needs to feel secure. While some people believe that money is a means for evil, others are obsessed with the pursuit of it and are never satisfied by what they have.

In the dimension of use (spending), we consider how we spend our wealth. People who acquire wealth only to count pennies and spend none of it would be considered cheap, while the opposite end of the spectrum would see people with wealth spending it endlessly only to end up broke.

In the dimension of management, someone who’s a micro-manager might study every tiny fluctuation in their investment, while someone on the opposite end of the spectrum would have no idea of what’s going on with their money, like missed bill payments, or not having any idea of their cash flow or savings.

Chances are you fall a few degrees to either side of the spectrum of these three money dimensions. It’s important to understand that “cognitive biases” and habits are just as relevant to our relational ties to money as they are to our romantic or personal relationships.

So, in order to foster a more balanced and secure relationship with money, here are 5 questions you need to ask yourself.

By pinpointing certain habits, behaviors, and emotions you have surrounding your wealth, you might be able to quell your anxiety about money or simply improve your relationship with it. Start by asking yourself a few questions and take some time to really consider the response to get a better understanding of where you fall on each of the dimensions and why that might be.

1. Do you notice a recurring mindset around money? Are you constantly worried you don’t have enough, or are you always thinking you should have more?

2. What values do you tie to money? Write out a short list of words that come to mind when you think of the terms “money” or “wealth.” Pay attention to whether these words can be categorized positively or negatively and try to assess your reason for selecting them.

3. What “money wounds” do you have from your past that might impact your relationship with money today? This might be your financial status while growing up, watching your parents struggle with money, feeling inadequate compared to your peers and what they had, or feelings of guilt when you receive or spend money.

4. What are your biggest fears surrounding money, and where do they come from? For example, if you have a fear of going broke, is that a realistic fear based on your current financial situation, or does it stem from a “money wound” from your past? Does your fear dictate how you use your money today?

5. How does your relationship with money make you feel about yourself? Is it a source of your confidence and self-esteem, or your anxiety? Feeling more confident in your wealth might mean you’re more secure when it comes to taking financial risks, but being overly confident and taking excessive risks can also be a problematic habit. If you’re constantly anxious or fearful that you don’t have enough money and you need to make more, consider if that is a reflection of your self worth in a way that might go deeper than just your finances.

When it comes to finances, especially investing or purchasing real estate, there are many things that are just out of your control. That said, you can still find ways to get a handle on the state of your finances to make it easier for you to understand how you acquire, use, and manage your money.

Vyzer offers investors a way to gain a clear overview of their assets and how they’re performing. If after answering the questions above you realize that you can improve upon how you’re spending and managing your money, you can use this platform to make informed changes based on real data so that you can get to a place where you feel more secure in your relationship with money.