For high-net-worth individuals and savvy investors, wealth generation is rarely linear. With multiple income sources—active income from businesses, passive income from rentals or royalties, and portfolio income from investments—revenue streams intertwine to form a complex financial web. While these diverse income sources boost financial security and growth, they also present unique challenges in effective management.

Managing multiple income sources requires strategic foresight, diligent tracking, a deep understanding of different asset classes, and an awareness of the various tax implications and regulations at play. It’s a demanding task that calls for precision, timeliness, and an adaptable mindset.

In this guide, we’re going to delve deep into the intricacies of managing multiple income sources. We’ll outline the challenges, unravel the complexities, and offer practical strategies to manage your income efficiently. Furthermore, we will explore the transformative power of technology in streamlining this process, focusing on how modern solutions like Vyzer are simplifying the task of managing multiple income streams for today’s busy investors.

Before we get into the challenges and solutions, let’s first understand the benefits of having multiple income sources and why it’s a widely adopted strategy among sophisticated investors.

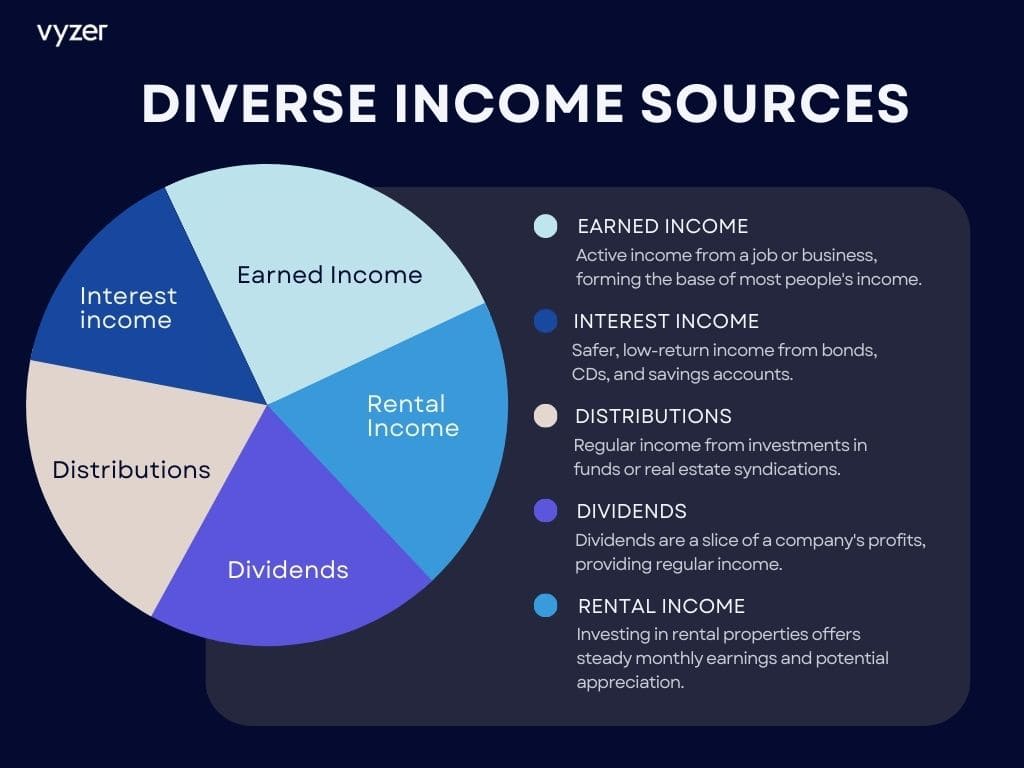

Diversification of Income: Similar to investment diversification, income diversification works on the principle of not putting all your eggs in one basket. It ensures your financial security isn’t tied to a single source, thereby reducing the risk of significant financial loss if one income stream fails or declines.

Increased Earning Potential: Multiple income sources open up avenues for increased earnings. This strategy can help you accumulate wealth faster, enabling you to reach your financial goals sooner than relying on a single income source.

Stability During Market Fluctuations: Having a variety of income sources can provide financial stability during market fluctuations. For instance, if your business income dips during an economic downturn, you could still have a steady inflow of cash from your rental properties or dividend-paying stocks.

Spreading the Wealth: The Benefits of Multiple Income Sources

Opportunities for Reinvestment: With multiple income sources, you have a higher potential for reinvestment. The income generated from one source can be reinvested into other income-producing assets, creating a cycle of wealth multiplication.

Tax Efficiency: Multiple income streams can also provide tax benefits. Depending on your location and the nature of your income, different tax rates may apply to different income types. With the right planning and advice, multiple income sources can be managed for tax efficiency.

However, while the advantages of having multiple income sources are considerable, managing them efficiently can be challenging. It’s a balancing act that requires careful planning, time, and an understanding of different financial domains. In the next section, we’ll explore these challenges in more detail.

While multiple income sources have numerous advantages, they also come with their fair share of challenges. Here are some of the most common:

Time Management: Keeping track of several income streams can be time-consuming, especially if they come from different sectors or involve varied activities. Each source may require separate management strategies and attention, leading to increased time investment.

Financial Complexity: Each income stream comes with its unique set of financial considerations, including different tax obligations, profit margins, and risk factors. Understanding and managing these intricacies can be complex.

Income Variability: Unlike a steady paycheck, some income sources can be unpredictable and fluctuate based on market conditions. This variability can make financial planning and cash flow management challenging.

Managing multiple sources of income can be an overwhelming task

Increased Paperwork: More income sources often mean more paperwork. You may need to deal with different contracts, tax documents, invoices, and financial statements, adding to the administrative burden.

Risk Management: Although diversification spreads risk, it doesn’t eliminate it. Each income source brings its unique risks, and managing these risks effectively is crucial to protect your wealth.

These challenges can make managing your wealth seem like a daunting task. But, with a well-thought-out strategy and the right tools, it’s possible to navigate these complexities efficiently.

In the face of these challenges, technology emerges as a powerful ally. It has revolutionized many industries, and wealth management is no exception. Today, technology offers a range of solutions designed to simplify the complexities of managing multiple income sources. Let’s explore some of the ways technology is making wealth management more efficient:

Technology platforms can automatically aggregate data from various sources, including different bank accounts and investment portals. This provides a consolidated view of your financial status, saving you hours of manual work, making it easier to understand your overall wealth.

Modern wealth management tools can automatically track the performance of your various investments. They provide regular reports, giving you insights into how each income source is contributing to your wealth. This makes performance tracking less time-consuming and more accurate.

With mobile apps and cloud-based platforms, you can access your financial data anytime, anywhere. This gives you the flexibility to manage your wealth on the go.

Most financial apps and platforms have alert systems that can remind you of upcoming capital calls or any significant changes in your financial status, it ensures that you’re never caught off guard.

With all your financial data at your fingertips, technology platforms make it easier to make informed decisions. They provide insights into market trends, investment performance, and more, helping you decide where to invest next, when to sell, and how to balance your portfolio.

Technology, when used correctly, can transform the daunting task of managing multiple income sources into a more straightforward, manageable process. However, while technology offers numerous benefits, it’s important to use it wisely and choose the right tools to suit your needs.

In the next section, we’ll explore the significance of choosing the right strategies and tools that align with your financial goals and lifestyle.

Managing multiple income sources can seem overwhelming, but it doesn’t have to be. Here are some strategies to help you stay in control of your finances:

Automate Where Possible: Utilize technology to automate tasks like tracking income, expenses, and financial reporting for each income source. There are numerous apps and software solutions like Vyzer, that can make this process easier and more efficient.

Develop a System: Having a clear, consistent system for managing your finances can help reduce complexity. This might include setting aside specific times for financial management tasks, using dedicated platforms, and developing standard procedures.

Diversify Strategically: Not all income sources are created equal. It’s crucial to diversify your income strategically, considering factors like risk, return, time investment, and your personal interests and skills. Similarly, strategic allocation of your investments across these diverse income sources is essential. The way you distribute your capital among various income sources can greatly impact the overall returns and risk exposure.

Strategic Diversification: A Breakdown of Multiple Income Sources

Stay Informed: Keep up-to-date with market trends, financial news, and changes in regulations that might impact your income sources. Knowledge is power when it comes to financial management.

Consolidate Financial Information: Use tools and platforms, that allow you to view all your financial information in one place. This can give you a clearer picture of your overall financial situation and make it easier to make informed decisions.

By implementing these strategies, you can streamline the process of managing multiple income sources and make it less overwhelming. Remember, the key to managing multiple income sources efficiently is to stay organized, use technology to your advantage, and regularly review and adjust your strategies as per the changing financial landscape.

While the strategies mentioned above can be incredibly helpful in managing multiple income sources, they can also be quite time-consuming. For busy individuals, time is a precious resource. This is where Vyzer comes into play. We believe that managing wealth should not be a task that takes away your time or freedom.

We focus on making wealth management simple and efficient. Here’s how Vyzer can help streamline the management of your multiple income sources:

Vyzer aggregates data from various sources, including different bank accounts, investment portals, and income streams. This provides you with a consolidated view of your financial status, ensuring you have the most accurate, up-to-date information.

With Vyzer, you can keep your finger on the pulse of your finances without the tedious task of tracking every transaction or performance metric. We automate this process, saving you time and making sure you have all the data you need when you need it.

Vyzer’s platform includes cash flow planning tools to help you manage your income and expenditures effectively. These tools can provide valuable insights into your financial habits and help you plan for the future.

We believe in the power of collective wisdom. Vyzer offers community benchmarking features, allowing you to compare your financial growth with peers anonymously. This provides valuable insights and learning opportunities.

As your virtual family office, Vyzer offers a suite of professional services designed to handle all your wealth management needs. These services include tax and legal advisory, private concierge services, and more all in one place.

Unlike traditional wealth management services that charge a percentage of the Assets Under Management (AUM), which can lead to inefficiencies and potential conflicts of interest, Vyzer takes a different approach. We charge a flat membership fee, providing a more cost-effective solution and ensuring that our interests are perfectly aligned with yours, regardless of the size of your wealth. This approach fosters a transparent and client-focused service.

With Vyzer, the focus shifts from the stress of managing your wealth to the freedom and opportunities it brings. Our platform empowers you with the control and confidence to manage your assets effectively.

Don’t wait to start your journey towards efficient wealth management. Start free with Vyzer today, and discover how we can streamline the management of your multiple income sources.