For investors seeking peak performance, balancing professional demands with personal life is key to long-term success. The high-stakes world of investing often demands significant time and mental focus, making this equilibrium challenging to achieve. Yet, maintaining this balance is fundamental for sustained financial success and well-being.

This article explores practical strategies for experienced investors to optimize their work-life integration. These approaches aim to enhance productivity and financial outcomes while safeguarding mental health.

The fast-paced investment world often traps professionals in a cycle of long hours and constant pressure. This relentless pursuit of success can feel like sprinting on an endless treadmill. The finish line seems to move further away despite increasing effort. This pace takes a significant toll on physical and mental health. It’s like running a marathon without training—eventually, you’ll hit the wall.

Striking a balance between work and personal life is essential for long-term success

Now, we all know the importance of work-life balance. It’s been hammered home by self-help books, wellness gurus, and those impossibly successful fitness buffs. But let’s face it. When you’re deep in the trenches, balancing work and life can feel like an impossible juggling act.

But here’s the thing: a healthy work-life balance isn’t just for yoga enthusiasts and green smoothie drinkers. It’s actually crucial for peak performance and long-term success. Numerous studies have shown that a healthy work-life balance can significantly improve productivity, reduce stress, and lead to better decision-making. According to a study by the American Psychological Association, individuals who maintain a healthy work-life balance are 21% more productive. That’s right, balance isn’t just good for your health, it’s good for business.

How do we juggle the demands of a high-stress job without dropping the ball on our personal lives? How do we run the marathon without hitting the wall? It’s not easy, and there’s no one-size-fits-all answer. But with the right strategies, tools, and a healthy dose of determination, it’s entirely possible.

This guide provides practical strategies to help you achieve balance, enhance productivity, and attain lasting success. We focus on actionable advice you can implement immediately in your professional life.

The journey towards achieving work-life balance begins with setting meaningful goals. Your goals should reflect both professional and personal aspirations. This creates a roadmap for integrating work and life harmoniously.

Think of your ultimate objectives as your destination, and your goals as the stepping stones leading you there. Each goal you set and achieve brings you one step closer to your destination. By breaking down your ultimate objectives into smaller, manageable goals, the journey becomes less overwhelming and more achievable.

Now, it’s important to remember that your goals should be SMART—Specific, Measurable, Achievable, Relevant, and Time-bound. This framework ensures that your goals are clear, trackable, and within your reach. It provides a sense of direction and keeps you motivated as you make progress.

However, simply having goals isn’t enough. They must align with your values and aspirations to be truly meaningful. This ensures you’re working towards something that genuinely matters to you.

A Harvard Business Review, study found that individuals with clear, meaningful goals are 10 times more likely to succeed. Reflect on your professional and personal aspirations when setting goals. Each achieved goal is a stepping stone towards your ultimate objectives. This progressive approach brings you closer to the desired work-life balance.

Time management is fundamental to work-life balance. It’s about consciously using your time effectively across professional and personal spheres. Think of time as a precious resource to invest wisely, like money. Prioritize tasks, delegate when possible, and set boundaries to protect personal time. In high-stress professions, focus on working smarter, not harder. Align tasks with your goals to contribute to work-life balance.

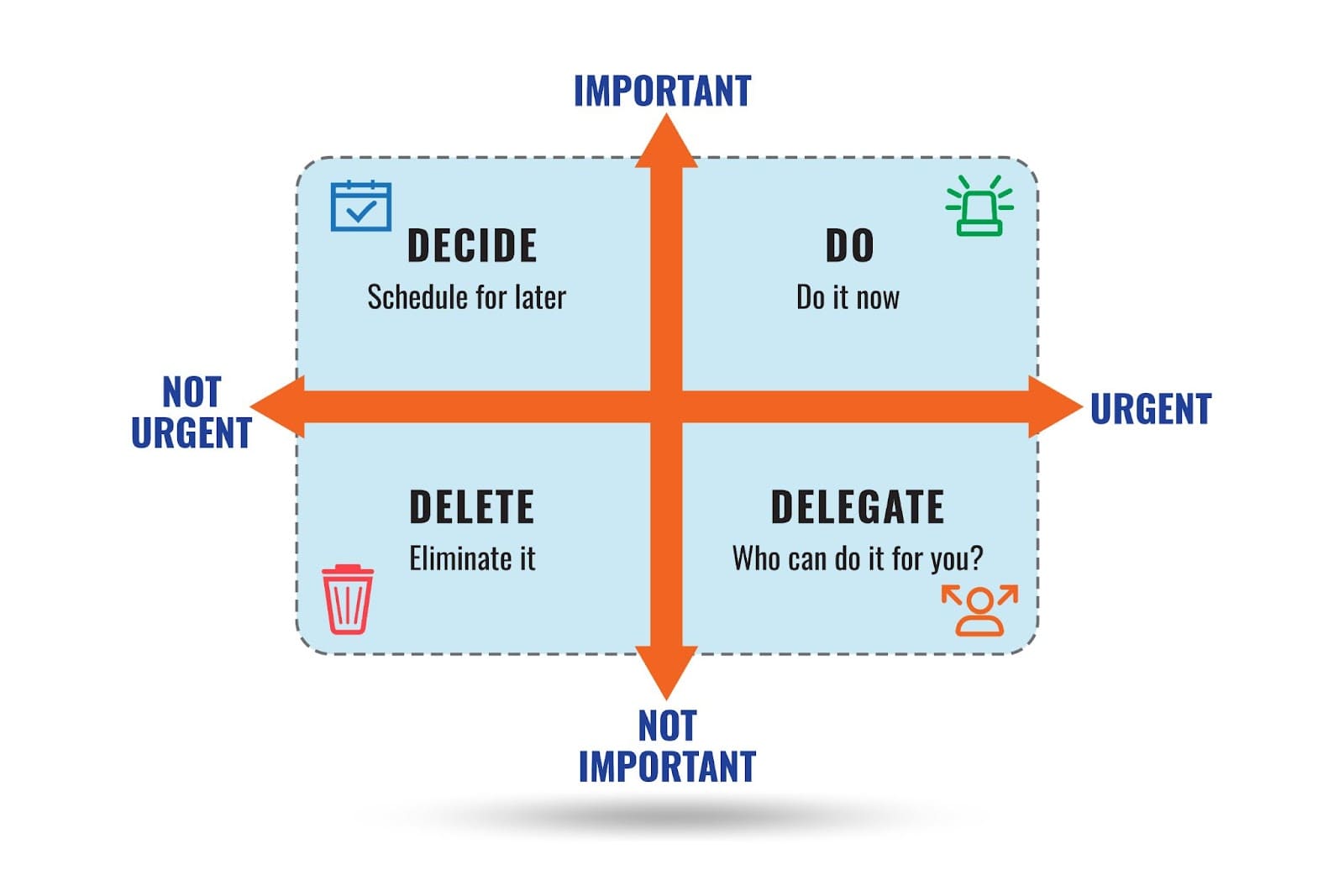

The Eisenhower Matrix, is an effective time management tool. It plots tasks on urgency and importance axes, helping prioritize effectively. This visual approach quickly identifies tasks needing immediate attention, those to schedule later, delegate, or eliminate.

Mastering time management ensures wise investment of each day’s minutes, facilitating desired work-life balance.

Financial planning aligns financial strategies with life goals, forming a critical bridge to work-life balance and financial freedom. This comprehensive approach considers current finances, future aspirations, and steps to achieve them. It involves budgeting, saving, investing, and managing debt. Controlling finances reduces stress and increases security, foundational for work-life balance.

The CFP Board reports individuals with comprehensive financial plans are twice as likely to feel financially secure. This security frees mental space and energy for other life aspects.

At Vyzer, we understand the unique needs of sophisticated investors like you. That’s why we’ve tailored our approach to cater to this diversity. We’ve created a guide on how to create your personalized real estate investing plan. This guide equips you with tools and insights to control your financial future, reflecting individual circumstances and goals. Integrating financial planning promotes both financial success and a balanced life where freedom and fulfillment coexist.

Managing intricate finances often challenges investors pursuing work-life balance and peak performance. Multiple income streams, capital calls, and multi[le entities can create a tangled web of complex spreadsheets or the need to hire costly professionals.

Technology offers powerful solutions to simplify these complexities. Digital wealth management platforms streamline financial planning and investment management.

These platforms provide real-time financial overviews and personalized recommendations aligned with your goals and risk tolerance. They consolidate financial information, facilitating informed decision-making.

Benefits extend beyond the ultra-wealthy. These tools help anyone control their financial future. They offer resources to understand finances, set goals, and make informed investment decisions, making investing more accessible and understandable.

Leverage technology to stay productive and connected on the go.

By leveraging these digital wealth management platforms, you can navigate the complexities of wealth management with ease and confidence. They bring efficiency to financial management and peace of mind, a key element in achieving work-life balance and peak performance.

At Vyzer, we understand the challenges faced by investors in high-stress professions all too well. Our team, led by our visionary CEO, has firsthand experience with the relentless demands of such careers. We created Vyzer to simplify your financial life efficiently and effortlessly. It’s like having a personal financial advisor in your pocket.

Vyzer helps track investments and cash flow with personalized insights—all in one place. It gives you control over finances, freeing time for what matters.

Our platform helps achieve financial goals and create a balanced lifestyle. It provides a clear financial picture, empowering informed decision-making.

Vyzer is your roadmap to financial future, with signposts and milestones guiding your journey. It reduces stress and improves focus, enhancing overall performance.

Work-life balance creates a lifestyle embracing work, personal life, and financial success. It aligns with your values and aspirations. With the right tools, like Vyzer, this balance becomes attainable. Remember, balance is a continuous journey, not a destination.

Experience Vyzer’s benefits with a free account. Take control of your finances and achieve work-life balance. Start your journey today.