Private debt is becoming increasingly popular as an attractive investment option, driven by the challenges of acquiring traditional debt and the lure of higher returns. When banks tighten their reins, borrowers, seeking flexibility, often turn to private lenders, even if it means a slightly higher interest rate. For the investor, this offers an appealing return rate on the loan, though not without its inherent risks.

The 2008 financial crisis triggered a pivot in investment strategies. In response to the crisis and to bolster economic recovery, the Federal Reserve significantly lowered interest rates. This action diminished returns on traditional investments such as government bonds and savings accounts. Consequently, investors sought better returns through alternative investments like hedge funds, private equity, and real estate. As traditional stocks faltered, alternative investments, which often exhibited low correlations with traditional asset classes, began to gain traction. They offered diversification, reduced risk, and heightened potential returns.

Three big changes happened after 2008:

Today, the popularity of alternative investments extends beyond those who navigated the post-crash era. A significant portion of Gen Z is exploring this domain, driven not just by potential high returns but by the desire for resilient investments amid challenges like inflation.

Private credit or loans, a subset of alternative investments, currently boasts about $1 trillion in assets under management. With projections hinting at significant expansion over the next five years. However, as with any investment, it’s vital to understand both its nuances and the balance between benefits and risks

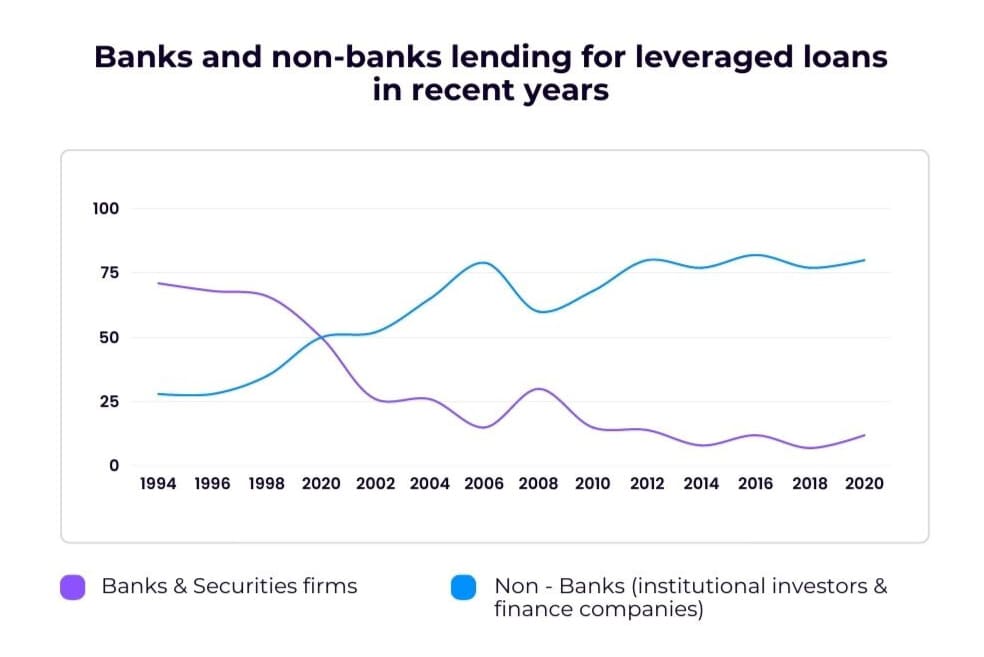

As of December 31, 2020

Source: S&P LCD

Private lending, in simple terms, is when individual investors or groups lend money directly to companies or people. It’s like a personal loan, but not from a traditional bank. Instead of companies going to a bank for money, they can get it from these private sources. For investors looking to step into this realm, there’s a lot to unpack:

Nature of the Asset: Unlike traditional loans mediated by banks, private loans come with a different risk-reward profile. The creditworthiness of borrowers can vary significantly, allowing for potentially higher returns on riskier deals.

Direct Control: One of the major draws for investors in the private lending space is the direct control they have over their investments. Instead of placing money in a diversified fund, they can choose specific ventures or individuals to finance, offering a tailored approach.

Diverse Opportunities: The private lending arena is vast. From real estate financing and startup bridge loans to personal loans, the options are extensive. Each category offers its own set of rewards and challenges, enabling investors to diversify within the niche itself.

Flexibility in Terms: As these loans are negotiated directly between the lender and borrower, there’s a higher degree of flexibility in terms of interest rates, repayment schedules, and loan covenants. This provides both parties with the opportunity to craft a deal tailored to their specific needs and risk tolerance.

Due Diligence is Key: Given the nature of private lending, thorough research and vetting are vital. Understanding the borrower’s financial position, the purpose of the loan, and the projected return is crucial. With private loans, the emphasis is on the investor’s ability to assess and manage risk.

Economic Indicators: The robust growth predictions for the U.S. private credit market, potentially reaching $1.5 trillion in the next five years, indicates more than just market confidence. It showcases a growing industry that, when navigated with caution, could offer solid returns.

The upward trajectory in today’s market showcases private lending’s promising potential.

As we previously noted, the U.S. private loans market is experiencing rapid growth, becoming an influential force in the U.S. financial sector. Here’s what’s happening now:

Several factors are fueling this growth. A major one is investors’ hunt for higher returns. Generally, borrowers in the private lending market aren’t as large as those in the broader syndicated leveraged loan market, and many don’t have any credit ratings. This perceived risk often translates to higher yields, drawing more and more investors to the table.

Despite its popularity, the private debt arena isn’t without challenges. Two main risks stand out: transparency and liquidity. Unlike broader loan markets, loans in the private debt segment often don’t get traded, meaning they’re less liquid. So, lenders usually intend to keep these debts until they mature.

However, the market showed remarkable resilience during challenging times. In 2020, for instance, as the world struggled with an economic downturn, private debt held strong. Lenders were proactive, making necessary adjustments and even offering capital boosts to help borrowers stay clear of bankruptcy.

Private lending has become an enticing avenue both for credit investors looking for solid returns and for those desiring a more direct lender-borrower relationship. But there’s a catch. With the influx of new investors, lack of comprehensive data, and the diverse nature of lending platforms, it’s tough to pinpoint the exact risk level in this market or identify the major risk bearers.

Traditional banks have been the go-to financial institutions for generations. Yet, recent failures of significant players like Silicon Valley Bank, Signature Bank, and First Republic Bank in 2023 have shaken trust in the banking world, highlighting concerns about its stability. This shift in sentiment has steered many towards private lending, seeking more dependable alternatives. Unlike banks with their often complex processes, private lenders present a streamlined, digital-centric approach. They promise quicker applications, flexible eligibility, and timely access to funds.

While the heightened risk of lending to individuals or companies often bypassed by traditional banks is offset by higher interest rates, the efficiency and adaptability that banks can’t match still make private lending an increasingly attractive option for modern borrowers

For investors contemplating adding private loans to their portfolio, it’s a unique blend of opportunity and challenge. As with any investment, the key lies in understanding the landscape, being diligent, and leveraging tools like Vyzer to effectively monitor their performance.

Managing private loans assets can be challenging due to its complex nature. This is where efficient tracking and management come into play, offering investors clarity and confidence. Recognizing this need, Vyzer rolled out enhanced functionalities for its Private Loans class, transforming how investors manage these assets.

Vyzer streamlines the management of complex private loans assets for informed and confident investing

Vyzer’s updated interface allows users to craft personalized amortization tables, fitting different scenarios from bullet and balloon payments to grace periods. This tailored approach ensures that you’re not stuck with a one-size-fits-all table but have one that aligns with your specific loan structure.

Markets change, and so do interest rates. Vyzer now lets members seamlessly adjust variable interest rates into their loan structures, allowing dynamic changes in response to evolving market conditions.

Every investor has a unique strategy. Whether you’re scheduling payments monthly, annually, or at a custom interval, Vyzer’s flexible transaction schedule ensures your strategy is executed precisely.

To make informed decisions, you need detailed insights. Vyzer offers a holistic view of your investment’s performance. Metrics like Annual Interest Rate, Internal Rate of Return (IRR), and detailed breakdowns of interest and principal payments give a clear snapshot of where your investment stands.

Anticipating future cash flows can be the key to proactive investment management. Vyzer’s projected distribution insights on the cash flow planning page provide members with a clear roadmap of upcoming payments.

In a world where private loans assets are on the rise, the tools you use to manage them can make all the difference. Vyzer not only aids in tracking these assets but provides real-time data and insights, empowering investors to understand the intricacies of their investments and make more informed decisions.

Unlock the potential of private lending: Begin your journey with Vyzer today.