Real estate investment has long been recognized as a smart and effective way to grow wealth. But beyond the potential for significant returns, there’s another aspect that savvy investors find incredibly appealing – the tax benefits. And let’s face it, who wouldn’t want to keep more of their hard-earned money?

In this blog post, we’ll explore seven key tax benefits for real estate investors that every property investor should know. Whether you’re a seasoned real estate investor or just getting started, understanding these tax benefits can have a significant impact on your bottom line.

When you purchase a property as an investment in the U.S., the IRS allows you to recover the cost of that property over time through annual depreciation deductions. This benefit comes from the understanding that physical properties degrade over time due to wear and tear, despite the fact that real estate often appreciates in value.

The best part? You can claim depreciation on your property even as it appreciates in value, creating a “phantom” or “paper” loss that reduces your taxable income.

It’s an advantage that’s unique to real estate investments, enabling you to generate positive cash flow from your properties while creating a tax loss. This advantage can be especially significant for investors in higher tax brackets.

There’s a catch though. The IRS only allows you to depreciate the building part of your property, not the land. And you must spread this deduction over a recovery period of 27.5 years for residential properties and 39 years for commercial ones under the General Depreciation System (GDS). Alternatively, you can use the Alternative Depreciation System (ADS), which has longer recovery periods of 30 or 40 years for residential properties and 40 years for commercial ones. You may be required to use ADS for certain types of properties or under certain circumstances. Additionally, you can only claim depreciation if you use your property for business or income-producing purposes, and you must stop claiming depreciation when you fully recover your cost or when you stop using the property, whichever happens first.

Despite these restrictions, depreciation is an invaluable tax benefit, as it helps investors offset their rental income, sometimes significantly reducing or even eliminating their tax liability on that income.

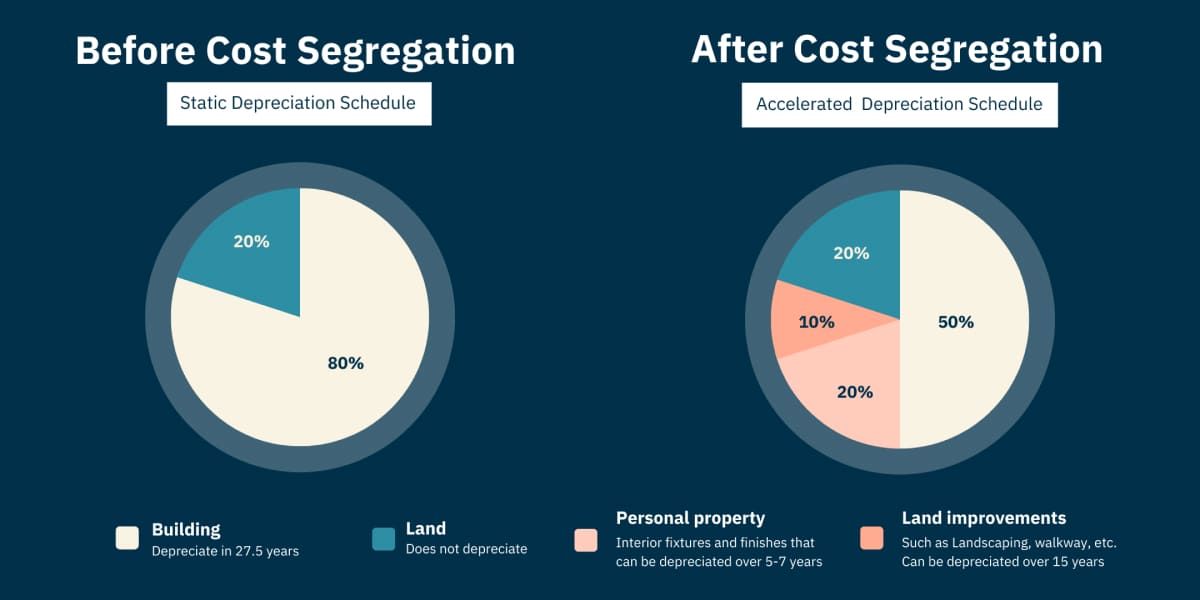

Cost segregation is an underused but powerful strategy for real estate investors. This tactic involves breaking down a property into its individual components and assigning them shorter depreciation periods. By accelerating depreciation deductions, cost segregation can significantly increase your tax savings, especially in the early years of ownership.

The components identified in a cost segregation assessment might include elements like carpeting, appliances, specialty plumbing and electrical, landscaping, and more. These components can be depreciated over five, seven, or 15 years, depending on the asset class, which is significantly quicker than the standard 27.5 or 39 years for residential or commercial properties under the GDS. Alternatively, you can use ADS, which has longer recovery periods as mentioned above.

Cost segregation requires a professional study conducted by a qualified tax expert or a cost segregation specialist that identifies and reclassifies personal property assets and land improvements that can be depreciated faster than the building structure. Cost segregation applies to real estate assets that are purchased, newly constructed, renovated, or qualified improvements. Additionally, cost segregation can enable the investor to claim 100% bonus depreciation for certain eligible assets that have a recovery period of 20 years or less.

While cost segregation studies can be complex and may require the assistance of a professional the tax savings they can produce make them well worth considering.

In the U.S., long-term capital gains (those on investments held for more than a year) are taxed at lower rates than ordinary income. This is great news for real estate investors, who often hold properties for several years before selling.

If you’ve held a property for more than a year, the taxable amount of a capital gain from selling that property can be reduced by a certain percentage, depending on your tax status. This capital gains tax discount can significantly increase the net proceeds from a property sale, enhancing your overall investment returns. As of September 2021, the long-term capital gains tax rates are 0%, 15%, or 20%—rates that are contingent on an individual’s taxable income. This is a significant discount compared to the highest ordinary income tax rate, which can reach 37%. Therefore, for high-income real estate investors, holding their investment properties for more than a year before selling can result in substantial tax savings, provided they keep an eye on potential tax law changes or consult with a tax professional.

The 1031 exchange, named after Section 1031 of the IRS Code, is a powerful tool for real estate investors. In a 1031 exchange, an investor sells a property and reinvests the proceeds into a similar or “like-kind” property, deferring capital gains and depreciation recapture taxes.

This strategy can be a game-changer for real estate investors, allowing them to preserve and grow their equity by reinvesting pre-tax dollars. It’s a unique opportunity to essentially trade up properties without incurring an immediate tax liability.

It’s worth noting that there are specific rules and timelines that must be followed to execute a 1031 exchange successfully, including identifying potential replacement properties within 45 days and completing the transaction within 180 days.

The pass-through deduction, also known as the Section 199A deduction, was introduced to level the playing field between large corporations, which benefited from significant tax cuts in the 2017 Tax Cuts and Jobs Act, and smaller businesses, which often use pass-through structures.

Pass-through entities like partnerships, LLCs, and S corporations don’t pay income taxes at the corporate level. Instead, their profits are “passed through” to the owners’ individual tax returns, where they are taxed at individual tax rates.

With the pass-through deduction, real estate investors can potentially deduct up to 20% of their net rental income, effectively lowering their tax rate on that income by 20%. There are restrictions, of course, based on income, type of business, and level of involvement, but for many investors, this can be a significant benefit.

Deferred Sales Trusts (DSTs) provide another method that real estate investors can use to defer capital gains taxes. This strategy can be particularly beneficial when you’re selling a highly appreciated property and want to avoid the immediate tax hit.

A DST works by selling your property to a trust, which then sells the property to the final buyer. The trust pays you in installments over an agreed-upon period, which can be up to 20 years or more. Because you’re only taxed on the installment payments as you receive them, this allows you to spread out your capital gains tax liability over many years.

The funds in the trust can be invested in a variety of ways, potentially providing you with income and further growth during the installment period. This strategy can be especially beneficial if you’re looking to diversify your portfolio, as the funds aren’t required to be reinvested in real estate.

However, it’s important to note that setting up a DST can be complex and requires the assistance of a tax professional or an attorney experienced in these transactions. It’s also crucial to understand that there are risks involved, including the financial stability of the trust and the potential for changes in tax laws.

Opportunity Zones are another exciting avenue for real estate investors looking to optimize their tax strategy. Established by the Tax Cuts and Jobs Act of 2017, Opportunity Zones are economically-distressed communities where new investments, under certain conditions, may be eligible for preferential tax treatment.

Investors can benefit in three significant ways from investing in Opportunity Zones, deferring tax on any prior gains invested in a Qualified Opportunity Fund (QOF) until the investment is sold or exchanged, or until December 31, 2026, whichever comes first.

This means that not only can investors defer and reduce their capital gains tax liability, but they can also potentially eliminate it entirely on gains from the Opportunity Zone investment if held for ten years. This can result in significant tax savings and potentially higher after-tax returns.

However, investing in Opportunity Zones isn’t without its challenges. These areas are often in distressed communities, which can carry higher risks. Additionally, to qualify for the tax benefits, investors must meet specific requirements, including investing through a QOF and meeting certain timelines.

As we’ve seen, there are numerous tax benefits for real estate investors that can significantly impact your bottom line. By understanding and leveraging these benefits wisely, you can maximize your returns and build a more profitable and resilient investment portfolio. But remember, every investor’s situation is unique, and tax laws are complex and frequently changing. That’s why it’s important to work with a tax professional and to continually educate yourself about these topics.