As the year draws to a close, taxes are top of mind for many W-2 employees. Preparing taxes can be notoriously confusing, especially when you factor in deductions, tax brackets, retirement contributions, capital gains, and other complex considerations.

However, what employees may not realize is that smart tax planning doesn’t start on December 31st – it requires year-round strategies to minimize your tax liability. The good news is that W-2 employees have ample opportunities through deductions, contributions, and savvy investments to significantly reduce taxes.

In this comprehensive guide, we’ll explore some of the best tax tips specifically for W-2 employees. You’ll learn insider strategies to optimize deductions, leverage retirement accounts for dual tax benefits, capitalize on investment tax perks, and avoid common pitfalls. With the right moves, you can enter tax season poised for the biggest refund possible and retain more hard-earned income.

The goal is to empower you to make informed tax decisions that provide immediate and long-standing financial advantages. So read on as we explore smart tax planning for W-2 filers. With the right information in hand, you can find multiple opportunities for optimizing your tax planning.

As a W-2 employee, your federal income taxes are calculated based on tax brackets that define different levels of tax rates from 10% to 37%. Essentially, as your taxable income increases, you progress into higher brackets that are taxed at higher rates.

Your specific tax bracket is determined by your filing status (single, married filing jointly etc.) and your taxable income after accounting for all deductions and exemptions. The thresholds that define the tax brackets are adjusted yearly for inflation.

Tax Deductions Reduce Taxable Income – By claiming deductions properly, you can potentially shift yourself into a lower tax bracket and pay taxes at a reduced rate. Common tax deductions include contributions to retirement accounts, mortgage interest, charitable donations and more.

Tax Credits Directly Reduce Taxes Owed– Tax credits like the Child Tax Credit allow you to subtract the credit amount directly from your total tax bill, resulting in significant tax savings.

Plan Investment Strategy Based on Capital Gains Rate – Your ordinary income and capital gains are taxed at different rates based on brackets. Planning investments with a focus on capital gain tax rates can optimize after-tax returns.

Maximize Retirement Contributions First – Pre-tax retirement contributions reduce your taxable W-2 income, meaning contributing early in the year could drop you into a lower bracket for a larger portion of your income.

As the year wraps up, take time to evaluate your tax situation and project whether you may fall into a higher tax bracket for 2024 based on your life situation and income changes. This bracket awareness can allow you to pull the right levers to manage your tax liability.

One of the key ways that W-2 employees can reduce their taxable income is through maximizing deductions. You essentially have two options when preparing your taxes – taking the standard deduction or itemizing your deductions.

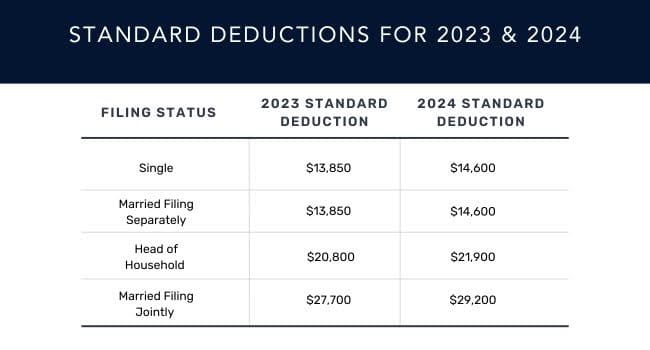

The standard deduction is a set amount based on your filing status – for example, $13,850 for single filers and $27,700 for married joint filers in 2023. If you don’t have a large amount of deductible expenses, the standard deduction may work to your advantage.

However, if your deductible expenses exceed the standard deduction threshold, you can choose to itemize deductions instead. Common itemizable deductions include:

Strategically timing certain itemizable deductions toward the end of the year can help maximize your deduction amount. For example, accelerating charity donations or medical payments into December instead of January may allow you to take advantage of deductions in the current tax year. Consider taking advantage of employer flexible spending accounts (FSAs) as well.

As the December 31st deadline approaches, take stock of deductible expenses that could make itemizing worthwhile this year. In particular, charitable contributions are easy to accelerate into the current tax year.

If you are just below the standard deduction threshold, consider making an additional charitable donation to your favorite qualified non-profit before midnight on December 31st. This last-minute gift could push your total itemized deductions over the standard deduction amount for 2023 taxes.

Even if itemizing won’t benefit you this year, extra charitable giving can provide a “bunching” tax strategy. By donating more in one year and less in the next year, you can take the standard deduction annually while still reducing taxable income over time.

Contributing to retirement savings accounts provides W-2 employees with an unbeatable twofold tax advantage: 1) reducing your current year’s taxable income and 2) unlocking tax-deferred growth on investments over the long run.

There are several types of accounts that enable this dual benefit, each with unique tax treatments:

401(k) – One of the most popular employer-sponsored plans, traditional 401(k) contributions reduce your taxable income for that year, while growth accumulates tax-free until withdrawal.

Traditional IRA – Much like a 401(k), contributions can be deducted to minimize taxable income and investments grow tax-deferred. Note there are eligibility requirements based on income levels and employer retirement plan access.

Roth IRA/401(k) – While contributions do not lower your current tax bill since they are post-tax, gains still grow tax-free and qualified withdrawals are tax-free in retirement. This provides back-end tax benefits.

Self-Directed IRA (SDIRA) – Enables broader alternative investment options like real estate that can produce returns exceeding IRA limits, while still retaining tax deferral advantages.

Savvy W-2 earners leverage retirement plans for both immediate tax relief through deductible contributions and future tax obligations in retirement by capitalizing on deferred tax growth. Contributing early in the year can reduce taxes more significantly.

The key is contributing the maximum amount allowed each year – in 2023 that includes $22,500 ($30,000 if 50 or older). In 2024, that limit rises to $23,000 ($30,500 for those 50 and above). Don’t leave this money on the table!

In addition to retirement accounts, W-2 employees can optimize their tax situation through strategic investing in taxable investment accounts. While not as advantageous as tax-deferred retirement plans, several factors make taxable investing worthwhile:

Preferential Capital Gains Tax Rates – Long-term capital gains (on assets held over one year) are taxed at maximum 20% for top tax bracket filers versus 37% for ordinary income. Assessing investments for long-term, low turnover potential is key.

Offsetting Capital Losses – Tax-loss harvesting involves selling losing positions to offset realized capital gain taxes owed on winning trades. Remaining losses up to $3,000 per year can directly lower ordinary income tax too.

Dividend Income – Qualified stock dividends are taxed at the lower long-term capital gains rates compared to short-term gains and interest income tied to your ordinary rate. Prioritize dividend payers.

Additional Tax-Advantaged Investment OptionsW-2 employees should also consider alternative real estate and business investments that offer sizeable tax benefits:

Leveraging one of these options to invest capital gains from stocks or other assets can provide excellent tax minimization and wealth building opportunities over both the short and long-term.

Beyond favorable capital gains rates, W-2 filers can benefit from deductions for investment fees/expenses, and opportunities to gift appreciated investments to heirs without capital gains exposure.

As the year closes, assess realized gains/losses and determine if losses harvested can reduce other gains realized. Also assess dividends received to project tax liability. With some planning, taxable investing can become more tax-friendly.

For W-2 employees with investments, a few additional planning strategies beyond basic capital gains and dividend rules can generate major tax savings:

Real Estate Investing Opportunities – Rental properties can generate rental income deductions, reduced tax bills from depreciation, and increased home office deductions. First-time homebuyer benefits also apply. Timing an investment property sale when income is lower optimizes tax treatment.

Structured Installment Sales – Selling an appreciated investment asset via an installment sale allows you to spread capital gains tax liability over multiple years. This avoids a huge single year tax bite.

Charitable Trusts – Funding charitable remainder trusts with appreciated securities passes investment returns to recipients tax-free and provides an income tax deduction when donated.

Tax-Efficient Equity Strategies – Tactics like tax-loss harvesting and holding assets optimally to achieve long-term gains provide significant tax alpha for portfolios over time.

Annual Reviews – Assess capital gains and losses already realized earlier in the year and make appropriate trades before December 31st. Be on the lookout for last minute tax planning opportunities.

While understanding the nuances of the tax code can seem daunting, a few straightforward planning moves focused on your investments and assets can save thousands of dollars annually. Every dollar kept away from Uncle Sam remains money kept for your future.

With complex tax codes and frequently changing legislation, errors and oversight on tax returns are all too common. As the famous quote goes “there are two certainties in life – death and taxes.” So don’t fall victim to traps that could lead to lost deductions, unnecessary taxes owed, penalties or more.

Below are some of the most common tax mistakes W-2 employees should seek to avoid:

Consider enlisting help from a CPA or tax specialist if you have particularly complex filings. Getting expert assistance can surface obscure ways to reduce your tax liability while taking care of filing intricacies so you avoid any flags from the IRS.

It can be overwhelming for anyone trying to find the best tax savings strategies to make sense of the tangle of tax codes and policies. However, while taxes may be unavoidable, missing out on deductions and benefits doesn’t have to be.

This guide outlined key areas from maximizing deductions to fully funding tax-advantaged retirement accounts to strategically investing for preferential tax treatment. Little moves like bunching charitable contributions, harvesting investment losses and placing assets in opportunity zones can yield huge tax rewards.

As the year wraps up, review your tax picture to ensure you are taking advantage of every strategy available for your situation. Consult experts if need be. Tweak your final weeks of spending and investments to align with tax minimization goals.

While many dread tax season, with the right preparation and planning, filing your return could reveal exciting tax savings that put money back in your pocket. Be proactive, be strategic, and never leave deductions on the table. By implementing even some of the tips in this guide, W-2 employees can become savvy tax planners in their own right.